Turnkey Group Celebrates 40th Anniversary

Turnkey news

Deborah Baxter takes a look back at how far technology has changed since the start of Turnkey IPS

Our 40th birthday present: a new remote control

Deborah Baxter, IPS Cloud Commercial Director, reflects on Turnkey’s 40-year evolution as leaders in insolvency software, and the big shifts of 2020 that will shape the industry for years to come.

This easy-to-use web interface hides a powerful system, including deep integration with third-party providers. Wherever automation and AI take the industry, IPS Cloud is ready.

With no servers to maintain or software to install, IPS Cloud is also ideally suited to supporting virtual teams. Perfect for a world where many of us have forgotten what the office looks like.

It started with the superbrain

Dr. Barry Wood learned to program at college in the early 1960s – we’re talking punch cards and rooms full of whirring tapes. Barry founded Turnkey in 1980, spurred by the launch of the brilliantly named Superbrain computer in 1979 – affordable computing had finally come to the world of business.

Barry’s first landmark sale was to Arthur Andersen. The firm was impressed not only by the accounting system he pitched, but by the fact he could singlehandedly haul some rather heavy pieces of valuable kit up several flights of stairs.

The request to build a system for insolvency practitioners was borne from this contract. The idea soon took off, with a number of large accounting firms signing up as founding clients. Word spread quickly through the close-knit insolvency practitioner community – computerisation had come to case management.

Today, some 90% of the UK corporate insolvency market uses Turnkey IPS, along with the world’s top 19 accounting firms.

And throughout those firms, we have 6,500 users – their detailed feedback informs every feature we introduce, benefitting the entire industry and every type of user.

The company is now led by Tony Wood, who shares his father’s passions for efficiency, technology and client satisfaction – although he draws the line at single-handedly lugging washing-machine sized computers up four flights of stairs. Health and safety has also moved on a bit in the last 40 years.

A transformational year

The pandemic has definitely affected the way we work at Turnkey, but it’s not stopped us investing to best support our customers.

We’re halfway through a large-scale internal transformation, which has included refurbishing our East Kilbride headquarters and increasing our headcount by 20% over the last two years.

We’re looking at operations too, with even more investment in customer relationship management to make sure we keep on delivering the support you need. We’ve also moved to agile development, so we can deliver product promises even faster than before.

Has it all been easy? Of course not. And there’s a further change to come, as we support more and more insolvency practices with digital transformation. In fact, we’d argue that digitalisation has shifted from ‘nice to have’ to fully-fledged strategic must-do.

That’s why we’re already working with the major third-party vendors, including banks, compliance experts, emerging technology specialists, and key government agencies. All to make sure the shift to digital delivers on its full promise, and supports your vision for the future.

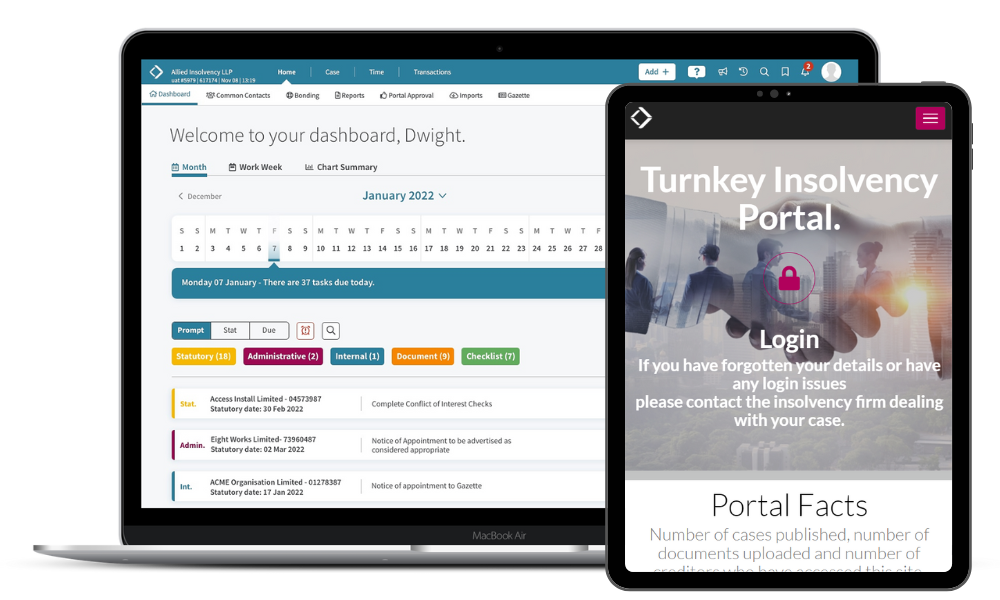

IPS Cloud and your journey to digital

All those years ago, Barry talked about the promise of a truly paperless claims process. Today – finally – it’s here. But that’s only a small part of the transformation that’s happening. Enter the Creditor Portal, which is underpinned by IPS Cloud.

Together,IPS Cloud and the IPS Creditor Portalform a secure platform that gives all your stakeholders the ability to access – and publish – digital case information. This is proving to be especially persuasive in encouraging hardened traditionalists away from pens, paper, and cheques. Some are even ready to ask the franking machine to enjoy a well-earned retirement.

Until then, we’ll keep on Zooming and Teaming our way through this evolutionary transformation and look forward to shaping the digital future for anyone wishing to join the party.

Of course, we’re not stopping there. Our users tell us what they need, and we build those needs into our development roadmap – expect even more automation of routine processes and AI-powered insights as time goes by.

Celebrating the future

Turnkey has come a long way since that first big sale. Yet our values and ethics remain intact. We continue to focus on our clients – increasing their efficiency, reducing their operating costs and improving their processes.

As for our 40-year anniversary? We can’t wait to celebrate with our clients when it’s safe to do so. Until then, we’ll keep on Zooming and Teaming our way through this evolutionary transformation and look forward to shaping the digital future for anyone wishing to join the party.

Download our Accelerate for IPS Cloud brochure to find out how automation can improve your operational performance.