Automating the Client Onboarding Process

Turnkey news

R3 Recovery Newsletter Feature – June 2022

Matthew Ellidge discusses the role of automation in insolvency case work.

Turnkey is delighted to feature in the Summer 2022 edition of R3 Recovery News. Below is an adapted version of Matthew’s article where he shares a personal account of his initial thoughts from the perspective of a former case manager.

Back in June 2021, I was an insolvency case manager and had signed up to a Turnkey webinar providing clients with an advance preview of automation within their IPS Cloud platform. I can remember being so intrigued by the concept of automating insolvency processes and to see the new Cloud platform in action, that I knew this was one webinar that I wasn’t going to skip.

While I was intrigued by the concept, I didn’t genuinely believe that an automation solution could accommodate all the different ways IPs choose to work. I also knew from my own experience that gathering all the information needed to commence a corporate insolvency case can be a difficult task, often requiring numerous physical meetings and countless email exchanges. So, while automation sounded great in theory, I wasn’t convinced that it would offer anything more than a novel convenience in practice.

Work smarter, not harder with Accelerate for IPS Cloud

Remove up to 90% of the manual effort in pre-onboarding checks through automation.

I remember coming out of the demonstration deeply impressed and somewhat shocked by what I had seen: Ben Park, of Tquila, deployed the robot and I watched as a new case was created and set up, with various company and director checks completed and the corresponding tasks marked as complete within IPS. All of this took place without any human intervention and at a speed beyond what is humanly possible.

The solution appeared far more robust and complete than I was expecting, but I still had reservations concerning the completeness of the solution. In my role of Case Manager, to really make a difference to my working life, the solution would have to impact upon – at least to some extent – the various manual pre-appointment checklists that are required on every case.

Creating an automated solution

Fast forward to January 2022, and I found myself as a new employee of Turnkey, joining them as one of their Subject Matter Experts. Shortly after joining I was invited to a workshop session with Ben at Tquila and, along with some of my colleagues who have also recently joined Turnkey directly from practice, we mapped out the onboarding process for a typical corporate insolvency case.

Together, we explored what was possible and how we might create a universal solution that would build on the demonstration given by Ben back in June last year.

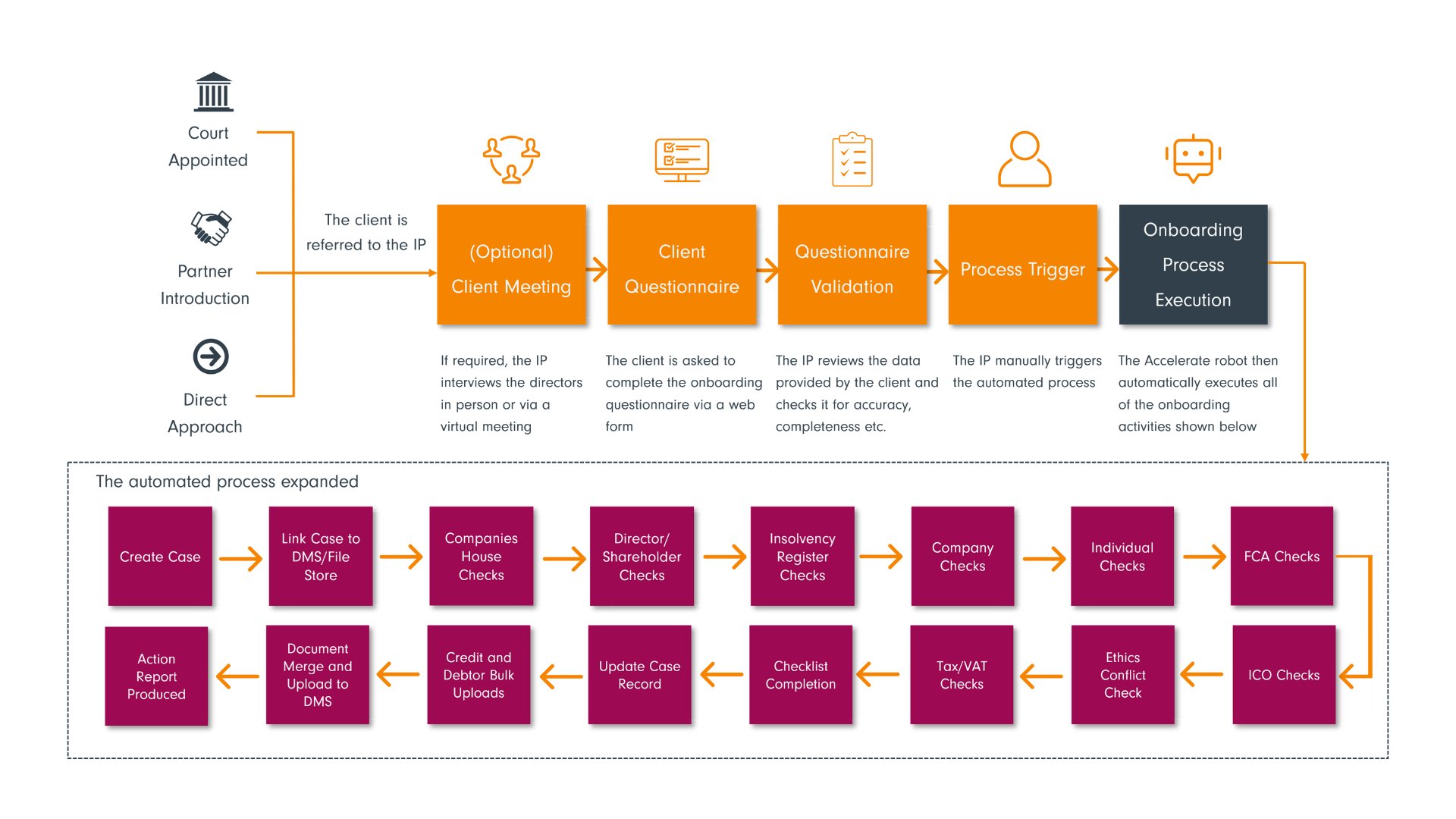

We agreed that a pre-automation web-form, accessible by the director and featuring all the standard, basic information that needs to be gathered when introduced to a new client would take care of the pre-deployment requirements for the robot. A link and password could be shared with the client at the point of initial introduction and when all the fields have been populated, the IP would receive an alert to check the information and, when satisfied with the data, trigger the robot.

The robot will then create the IPS case and automatically link it to any document management system utilised.

Following the above step, the robot will move on to performing all the various checks that are required: Companies House; Director / Shareholder ID and AML checks (interfacing with third party AML software); FCA, ICO and HMRC checks. As each check is completed, evidence is collated either by the robot taking screenshots or downloading the documents into the case file area.

Crucially, as the robot completes these tasks, it marks them as completed within IPS and where applicable, attaches evidence to the record.

Next, the robot tackles the pre-appointment checklists, populating these with all the basic information leaving the Manager or IP to focus on the ‘judgement-call’ responses within each checklist. The robot will even scan the case folder to check for a completed creditor and debtor spreadsheet and if found, proceed to import the data into the case.

As Ben had previously demonstrated, the robot also attends to all the pre-appointment document merges, such as a director questionnaire which is emailed to the director automatically, or a letter of engagement, which can be completed and sent to the case Manager for tailoring and approval.

The robot finishes the onboarding process by producing an action report which logs every task that it has completed, and this again, is saved within the IPS case document area.

Keeping case management compliant

Following the workshop, I was left with a sense of inevitability in terms of the role of automation in insolvency case work. In the context of corporate case onboarding, all the tasks completed by the robot are crucially important from a compliance perspective, yet they are undeniably repetitive and are at risk of being overlooked – especially during busy times when a staff member’s attention is being pulled from one case to another.

The automation solution we are developing promises to look after these mandatory but mundane tasks, completing them faster than any human could – and always without error or omission – completely freeing up staff to focus on more valuable work.

I would have loved automation to have been available during my time in practice and believe it has the potential to transform the way insolvency practices work and crucially, to make the job more enjoyable. I also believe that we are still only scratching the surface of what this nascent technology will be able to do in the future. So, whether you’re working in insolvency practice or, like me, an employee of Turnkey, it’s an incredibly exciting time to be working in this industry.

Get in touch to discover how automation can transform your client onboarding process.

Meet the Author

Matthew Ellidge, IPS Product Specialist, Turnkey IPS

Matthew is a former Insolvency Case Manager with over 25 years’ experience working in the insolvency industry, prior to joining Turnkey as a Subject Matter Expert at the start of 2022.

Got a Question?

Just drop the team a message and we’ll get back to you as soon as we can.