IPS Cloud

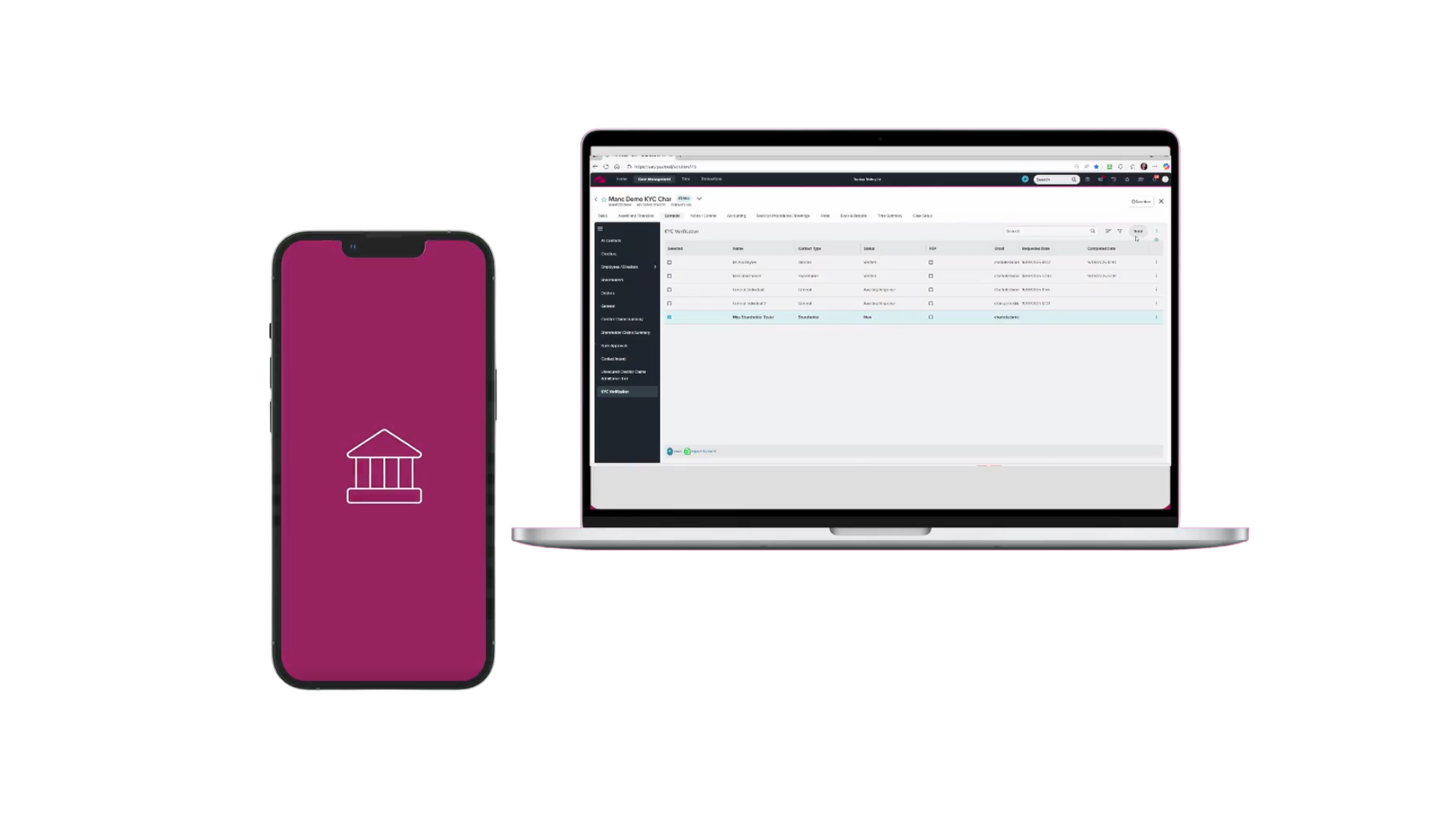

KYC Verification

Know Your Client in as little as 30 seconds, with KYC Verification for IPS Cloud, brought to you by Turnkey and OneID .

What is Know Your Client (KYC)?

Know Your Client delivers document-free identity verification for insolvency compliance in real time, using bank-verified data. Complete KYC, PEPs & Sanctions, and watchlist AML checks on directors, shareholders, or general contacts of companies going through insolvency, without the need to scan passports, driving licences, or other documents.

Fully integrated into IPS workflows, it protects against fraud, ensures regulatory compliance, and delivers a seamless, frictionless experience for customers.

No manual checks

No fake documents

Bank reassurance

How does the process work?

About OneID

OneID is the only UK Identity Service that uses bank-verified data to create absolute certainty between a business and its customers in a fast, simple, secure and truly digital way.

Along with bank-verified data, they also offer businesses the flexibility to choose from trusted data sources, like mobile network operators, government identity documents, and their own digital identity wallet—depending on the business and compliance needs they have to meet.

OneID real-time verification solutions balance digital ease with the strongest counter-fraud measures. It seamlessly blends into the digital habits of today’s customers, enabling businesses to verify 98% of UK adults with minimal friction and maximum confidence.

OneID is a government-certified, FCA-regulated, and a B Corp business committed to making the digital world safer. Headquartered in the UK, they’ve brought together experts in Digital Identity, Payments, Banking, Technology, and Government to help businesses build trust and security at scale.

Ready to take your verification process to the next level?

Get in touch to speak with one of our experts about KYC Verification for IPS Cloud.